by Vlad Cuc

A business in Romania can be registered by both natural persons and legal entities. A Romanian business form has to be incorporated with the required minimum share capital, deposited in the company’s bank account.

Also, it is allowed for local businesses to hold their own assets and to establish a management structure in accordance with the provisions of the Romanian law.

Another basic requirement for company formation in Romania is to assign a registered office for the newly founded legal entity. Our lawyers can help you open a company in Romania in just a few days. We can also offer you details about the process of company formation in Romania.

| Quick Facts | |

|---|---|

| Types of companies in Romania |

– limited liability company, – joint stock company, – partnership (limited and general), – company limited by shares, – branch office, – sole trader |

|

Minimum share capital for LTD Company |

EUR 1 |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation (approx.) |

5 days |

| Corporate tax rate in Romania |

– 16% standard rate; – 16% applied on the taxable profit or 5% on the revenue (the highest value will be selected) for companies involved in gambling and nightclubs activities, – 1% – 3% for micro-companies |

| Dividend tax rate |

5% (exemptions are available) |

| VAT rate |

– 19% the standard rate; – 9% for foodstuffs, pharmaceutical products, hotel accommodation, agricultural supplies, etc., – 5% for social housing, books, newspapers, restaurants and catering units, admission to sporting events and to amusemen parks, etc., – 0% for intra-community transportation, international transportation. |

| Number of double taxation treaties (approx.) | 88 |

| Do you supply a registered address? |

Yes |

| Local director required for company formation in Romania | No (obligations can appear for the board of directors) |

| Shelf company available |

Yes |

| Redomiciliation permitted |

Yes |

| Electronic signature |

Yes |

| Is accounting/annual return required for company formation in Romania? |

Yes (both) |

| Foreign-ownership allowed | Yes |

| Any tax exemptions available? |

– for the reinvested profit of a company, – for activities related to innovation, research and development, – for companies operating in industrial parks, etc. |

| Tax incentives for company formation in Romania |

– for research and development activities, – for investments in professional and technical education, – for companies that fall under the micro-company regime, etc. |

Table of Contents

How long does it take to open a company in Romania?

The procedure of company formation in Romania will take 5 working days (this is calculated since the date in which all the necessary documents are subscribed with the local authorities).

In order to register a limited liability company, the necessary minimum share capital is of RON 1, while for a joint stock company, the capital is established at EUR 25,000 (approximately RON 124,000 as of 2024).

What type of Romanian company should I create?

Foreign investors can open the following types of Romanian companies (structures): the Romanian SRL, the Romanian subsidiary, the Romanian branch, the Romanian representative office (liaison office).

The representative office in Romania can be established only for certain types of activities; our team of Romanian lawyers can offer advice on the documents necessary to register a liaison office here and help you start a business in Romania.

How can an investor register a Romanian SRL?

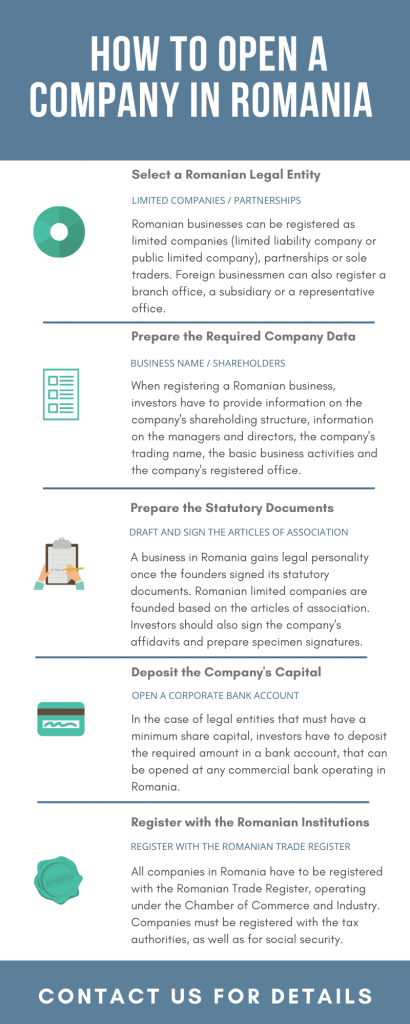

Since the Romanian SRL is the most common business form selected for company formation in Romania, we will present below the steps for forming this type of company. Prior to starting the registration process, the investors must gather all the documents and information required by the local authorities.

Some of the most common information that must be presented upon the registration of a new Romanian business are the following:

- personal information regarding the company’s shareholders, such as their names, nationalities, country of residence and date of birth;

- the name of the person who is appointed as a general manager;

- the company’s proposed name and the business activities that will be developed here;

- the participation of each shareholder at the company’s capital, the nominal value of each share and the percentage of shares owned by each shareholder;

- the company’s registered office (the proof regarding this information is done through various documents that attest the fact that the company operates in the given location).

One of the main steps for company formation in Romania is to assign a suitable trading name for the company. This registration step is completed with the Trade Registry, where the investors will complete a reservation form in which they will mention their main options for the desired company name.

After the file is submitted, the Trade Registry will provide a certificate stating that the reservation for the company name was registered. The document is issued on the same day when the application is made and it has a limited validity (of only 3 months).

Foreigners who are not residents may also open a business in Romania, but they will need to declare on their own responsibility that they do not have any fiscal debts in the country where they reside (an original document is generally required).

If the document is written in a foreign language, a certified translation has to be added to the file, and this is done through a public notary.

Once all the required documents are submitted with the Trade Register Office and after the institution will verify the applicant’s file, the company will receive a unique registration code (CUI).

Formally, a company is recognized as a legal entity in Romania once it is registered with the Trade Register. We can help you with the legal procedures in order to start a business in Romania in just a few days.

Are there any other types of Romanian SRL?

Yes, the legislation in Romania provides an alternative to the Romanian SRL; this is represented by the Romanian SRL-D, which was designed to assist young entrepreneurs in starting a business.

This business form is especially addressed to persons who have never been the associates or the owners of other companies in Romania or in any other country of the European Union (EU).

In order to register the SRL-D, there has to be a maximum of 5 shareholders; the company can carry out only certain types of economic operations. For example, the SRL-D can’t have as its business operations activities that are related to fields such as: insurance, gambling, real estate, tobacco or alcohol.

A major advantage of this company type is that the investor can obtain many tax exemptions and grants, because it was created to increase the number of investors on the local market (especially of young investors).

It must be noted that the legislation in Romania stipulates that a SRL-D can maintain this status for a period of 3 years, after which it is necessary to take the necessary steps to acquire the SRL status. Therefore, if this is the case for your company in 2024, it is advisable to receive legal assistance on the procedure.

Is there vital information I should know related to company formation in Romania?

Yes, and this is because each legal entity has its own characteristics. For instance, the Romanian representative office may only start marketing activities; it can’t be registered with the purpose of developing commercial operations.

We recommend you to contact us before making a final decision and starting to open a business in Romania.

Romanian companies, new obligations under the 2024 Fiscal Code

The Romanian authorities have introduced a new set of fiscal measures in 2024. They are regulated under the Government Ordinance no. 16/2022 and they were published in the Official Journal of Romania on 15 July 2022.

The new fiscal regulations bring many changes regarding the following:

- the corporate tax;

- the taxation of dividends;

- the taxation of Romanian companies that qualify as micro-companies;

- the types of companies that can’t benefit from the micro-company regime;

- the tax on properties, etc.

A new regulation referring to the VAT applied to flavored and sweetened non-alcoholic beverages. Instead of the reduced rate of 9%, these products are charged starting with 1 January 2023 with a tax rate of 19% (CN code 2202 99 and CN code 2202 10 00).

Additionally, it must be noted that the charge of VAT was modified in 2024 as well. Therefore, it is worth knowing that several goods and services which were charged with the reduced 9% VAT rate are now charged with the standard VAT rate.

What are the new regulations concerning the Romanian micro-company?

The Romanian micro-company regime was created so that it can promote investments amongst young entrepreneurs, who benefit from a preferential tax regime. This policy has been very successful, as many Romanians decided to start a business, given its advantages.

Under the new Fiscal Code, the rules concerning the micro-company regime were modified, including the definition of what a micro-company can be from a legal perspective.

The regulations introduced by the Government Ordinance no. 16/2022 provide that a Romanian micro-enterprise will be defined by the following:

- regardless of its business operations, it is not allowed to have more than 20% of the turnover obtained from consulting/management services;

- it is necessary to hire at least 1 employee working in a full-time job (as opposed to the previous law, where the company could operate without any employee);

- the turnover of the company can be of maximum EUR 500,000;

- the shareholders of the micro-company should have maximum 25% of the participation titles in maximum 3 other micro-companies.

The corporate tax charged for companies qualifying for this regime is 1% if the revenues are below EUR 60,000 or 3% for revenues above EUR 60,000.

What are the employment obligations of a Romanian micro-company?

As said above, the Romanian micro-company must hire minimum 1 employee in order to benefit from the micro-company tax regime. Having an employee is no longer optional, but an obligation.

More so, the employee must be a hired based on a full-time contact. Our team of Romanian lawyers can present in-depth information on the employment regulations currently in force in Romania.

Please mind that if the micro-company has only 1 employee and the contractual relationship ends, regardless of the reason, the company must seek to hire a new employee in order to retain the micro-company regime.

Thus, the obligation of the company is to hire a new employee in a period of 30 days since the termination of contract. Here, there are 2 options:

- hire an full-time employee on an indefinite employment contract;

- hire a full-time employee with a fixed-term contract signed for a period of minimum 12 months.

The new fiscal code imposes a new corporate income tax for the micro-company regime, which is charged at a rate of 1% regardless of the number of employment contracts or other conditions.

A company will retain this beneficial tax system as long as it maintains the conditions stipulated for the new definition of a micro-company. Provided that the company will not be able to fulfill all these conditions, then the standard taxation system will apply.

In the case in which this applies, the company will be considered a regular corporate tax payer from the quarter when any of the micro-company conditions mentioned above is not met by the legal entity.

Thus, the company can go from a micro-company regime to a corporate taxpayer regime during the same financial year. You can find out more information concerning this rule from our Romanian lawyers.

LOWEST TAXES IN EUROPE FOR THE ROMANIAN MICRO-COMPANY: Up to 1% corporate tax

A foreign company can be sole shareholder (if LLC) or the foreign company can be shareholder together with at least 1 other shareholder which can be legal entity or private person (if joint stock company).

The most common way to start a business in Romania is by registering a limited liability company (societate cu raspundere limitata – SRL).

Companies in Romania can also take the form of partnerships and joint stock companies, which are commonly incorporated in this country. Depending on the nature of the activity developed here, these companies that can also be liable for the payment of VAT in Romania.

In order to open a business in Romania, it is necessary to register it with the National Trade Register Office, an institution which operates under the Chamber of Commerce and Industry in Romania.

This body, the National Trade Register Office, is set up as a public institution that gathers data on all companies that are registered at a national level. You can get more information about company formation in Romania from Avocati.ro, an excellent online resource.

Click to download our free guide to company formation in Romania, containing information for the setup of Romanian branches and representative offices, joint stock and SRL companies.

This provides information regarding the costs of company formation in Romania, the procedures to follow, the documents investors must prepare and any other requirements imposed by the law.

It provides information on the procedure and requirements in order to open a company in Romania, the costs associated with the registration procedure, as well as on the documents that have to be submitted with each particular institution.

Contact us to find out how to register a Romanian Micro-Company and pay 1% tax!

Our Romanian law firm can assist local and foreign investors throughout all the procedures related to the company formation in Romania:

- we will reserve a company name at the National Trade Register on your behalf;

- we will draft the following documents:

- affidavits – they must be completed following the standard format, as requested by the Romanian law;

- specimen signature – it must be signed by the persons who will be company directors;

- the articles of association and by-laws of your future Romanian company.

Investors can rely on our Romanian lawyers for the below mentioned legal steps necessary for the registration of a local company:

- subscribe the share capital on your behalf – it varies in accordance with the business form that was selected for incorporation;

- open the company’s bank account with the bank of your choice (our Romanian lawyers can assist in depositing the initial share capital, which depends based on the selected business form, but it also refers to the additional current account for the company’s operations – both types of Romanian bank accounts can be set up without your personal presence in Romania);

- offer a suitable company office that is necessary for the registration formalities (also, our law firm is able to provide virtual office services in Romania, including mail forwarding, local phone numbers and secretarial services);

- submit company documents with the local Trade Register and represent investors in front of the Trade Register judge.

What are the requirements for the shareholders/directors of a Romanian business in 2024?

When opening a company in Romania, foreign investors are not imposed with any restrictions.

This gives the right to company formation in Romania to both local and foreign businessmen. Please mind that there aren’t any requirements with regards to the nationality of the appointed directors. Romanian law also allows corporate shareholders and directors.

What are the duties of the Romanian Trade Register?

Legal registration operations such as the formation of new Romanian companies, change of the social headquarters of the company, change of any clause of the articles of association, cession of social shares and others, require the verification of the file and documents by a clerk and a Trade Register judge.

The Trade Register judges review the submitted information, the correctness of the paperwork from the legal point of view (articles of incorporation, affidavits, specimen signatures etc.) and either request further information from the shareholders and/or directors or their representatives or approve the operation.

From the date of approval of the incorporation of a Romanian company, the Romanian Trade Register usually requires approximately 3-5 business days to issue the Certificate of Incorporation. Other useful information about the Trade Register and its activities throughout Romania are presented below:

- the Trade Register is a public institution and is obliged under the local law to issue, on the expense of the person requesting it, official copies of the documents registered in its database;

- it must also provide information regarding the registered data and to offer information in regards to the existence of certain documents in the records of the Romanian Trade Register;

- the decisions of the Trade Register judges are open to appeal in a term not exceeding 15 days;

- the Romanian Trade Register has set up offices in 42 counties, at a national level.

What is the legislation regulating the activity of the Romanian Trade Register?

The activity of the Romanian Trade Register is regulated by multiple rules of law; our team of Romanian lawyers can present at length the basic regulations referring to this institution, which is regulated by the Law no. 26/1990 – the law on Trade Register.

The activity of the institution also falls under the regulations of the Law no. 31/1991 – the Law on Companies, the Law no. 33/2000 – on insurance activity and insurance supervision and others.

The activity of the institution also falls under the regulations of the Law no. 161/2003, the Law no. 297/2004, the Law no. 359/2004, the Law no. 566/2004, the Law no. 1/2005, the Law no. 93/2009 or the Law no. 202/2010.

Additional rules of laws and decrees are applicable as well and this why we highly recommend businessmen or to any interested party to request information from our team of Romanian lawyers who can also help you with the process of company formation in Romania.

How many businesses were registered in Romania?

Since the Trade Register is the main institution where local businesses are registered, the institution also holds the current statistics on the businesses incorporated here. The latest data, for 2022, shows the following statistics on limited liability companies in Romania:

- the highest number of companies registered with the Trade Register was recorded in Bucharest, the capital city of the country, which accounts for 246,118 active limited liability companies;

- in the country of Timis there are 51,055 limited liability companies and in Iasi 37,424;

- in Cluj, one of the largest cities in Romania, there are 62,556 companies;

- in Brasov, another important city in Romania, the number of active companies is of 37,064;

- in Prahova there are 33,310 companies.

Overall, Romania has 1.1 million active companies, most of which are limited liability companies (1,105,079 companies). A very small share is represented by joint stock companies, of only 8,180 active businesses.

Our team of lawyers can help you open a company in Romania registered as any of the legal entities that are regulated by the national law.

In most cases, foreign investors will opt for the limited liability company, as this entity is designed for small and medium-sized companies, and the majority of businesses in Romania can be included in this category. Please contact us if you want to start a partnership as well.

You are also invited to contact our Romanian law firm if you are interested to be relocated here on a long period time. This can imply that you may also want to buy a property in Romania.

While foreigners benefit from the right of purchasing a residential property for personal usage, the acquisition of land is limited only to specific situations, and foreigners must comply with stringent rules.

Short history of the Romanian Trade Registry

The history of the Romanian Trade Registry (in the legal sense of the word) begins in 1864, when the authorities of that time created the Chambers of Commerce and Industry.

In 1884, a new legislation was created, the Law on Companies Registration, which stipulated that the data on local businesses must be registered and maintained following specific rules by the Trade Registry.

Throughout the years, the institution maintained its activities, up until 1950, when the Trade Registry was abolished as a consequence of the political regime that was installed in the country at that time.

The institution ceased its operations up until 1990, after the fall of the communist regime. Since 2002, the institution operates under the Romanian Ministry of Justice and, since then, it became a full member of international structures, such as the European Commerce Registers’ Forum and the Corporate Registers Forum.

How can one open a company in Romania, with the Trade Register in 2024?

The procedure on how to start a business in Romania depends on the type of legal entity that is selected for incorporation.

All types of companies that are recognized under the Romanian law have to be registered with this institution and this also refers to businesses that are not considered corporate bodies (such as the sole trader); our team of lawyers in Romania can provide legal assistance on how to register a local company.

Thus, the documents required by the institution will also vary. In the case of a private limited company, one of the most common ways to start a business here, investors have to prepare numerous documents and this is why we recommend to get in touch with our team of Romanian lawyers.

For this type of company, there are 19 documents that have to be completed, for example.

Verification of a Romanian company

There are quite a few reasons why a foreign investor would find necessary it necessary to conduct verification of a Romanian company; the most important being:

- the imminent entering into a contractual relationship with the respective company – in this case the foreign party would prefer to gain insight into some background information about the respective Romanian party;

- a pre-verification before purchasing shares or entering into any kind of joint venture with the Romanian company – this could include a wide array of verifications, legal as well as financial;

- a verification of a certain shareholder to better understand the value of shares the person (or other legal entity) holds – this might be required for different kinds of procedures abroad (such as personal background checks).

In the opinion of our law firm the verification of a Romanian company will have to be treated separately as there are 2 different types of verifications:

1) The regular verification of a company. This includes:

- obtaining a trade register extract (company information is public in Romania) which can show the following information company name, address, date of registration, shareholders and directors as well as some additional information;

- obtaining the last official copy of the company’s Articles of Association (stamped by the Romanian Trade Register);

- obtaining the last filed accounts of the company, filed with tax authorities and which can be obtained through the Romanian Ministry of Finance.

These records show the income of the company, profit etc. There is a very important note here: the last filed accounts can only be provided if the respective Romanian company has actually filed any accounts.

Although these filings are compulsory, many companies do not file on time. Even so this is a good indication on the good standing of the respective company.

An important matter to be taken into consideration when performing a verification of a Romanian company or its shareholders: Romania does not have a database to verify the assets and/or real estate properties of a person or company.

One can find out the owner of a certain property for instance however in the order for this to happen he will have to have the full details of the property in question. A simple search on the properties owned by a company is not possible.

2) A complete due diligence procedure performed on the Romanian company. This is usually done before a merger/acquisition, purchase of shares etc. and can include:

- all the verifications performed at par. 1 above;

- legal due diligence, which can apply to all past contracts, business relationships, and payments related to the contracts with business partners, investors etc. as well as real estate purchases for instance;

- financial verification (audit).

The legal due diligence can be rather straightforward or can take an important amount of time depending on the volume of work: number of contracts signed, transactions, and general company activity.

With regards to audit, this implies verification of all the financial transactions, good standing with the Romanian tax authorities, general financial situation, lawful issuance of all financial documents (invoices, payments etc.).

Basically this kind of verification insures that a respective Romanian company has all accounting and financial records and tax payments up-to-date and per the legislation in effect.

Reasons for starting a company in Romania

Besides the reasons that were presented above, investors can opt to set up a business in Romania due to other important matters – which can refer to the strategic location of the country, the tax benefits investors can obtain here and other aspects that can be of importance in this case. Our team of lawyers in Romania have prepared a short list that should be taken into consideration when starting a business here:

- Romania is very close to important economic and cultural centers in Europe – Bucharest is 3 hours away from London and 2 hours away from Berlin (when traveling by plane);

- the internet connection is very good in Romania – it occupies the 5th rank at a global level on the internet speed (37.4 Mb/s);

- the country occupies the 6th place at a global level with regards to the IT specialists and those searching for the best business to start in Romania can easily select this sector;

- although the country has various economic issues, in 2017 Romania had the fastest growing economy in the EU;

- corporate taxes can be considered low – the standard corporate tax is of 16%, while micro companies enjoy a preferential tax regime, with very low taxes, of only 1% and 3%.

See other related info:

Establishing a representative office or company branch

Purchasing real estate in Romania

NOTE: This is not intended to be a complete list of documents or a complete set of costs to set up a Romanian company . Contact us for in-depth information. Our Romanian law firm is prepared to assist foreign investors in any matter concerning the legislation regulating the activities of local businesses.

MHC Law Firm with affiliates all over the world. We salute our latest partnership with CompanyFormationNetherlands.com, the provider of the best guide on how to set up a company in Netherlands.