by Vlad Cuc

Our lawyers can help both local and foreign businesses in the process of VAT registration in Romania, so you can always rely on our team if you need this service.

Our lawyers can assist those who have to obtain a VAT number in this country and can also provide legal advice on the VAT compliance applicable here. In Romania, the VAT number must be comprised of 10 characters.

Extensive information on the procedure for VAT registration in Romania can be presented by our Romanian law firm.

Table of Contents

What is the VAT registration procedure for foreign businesses?

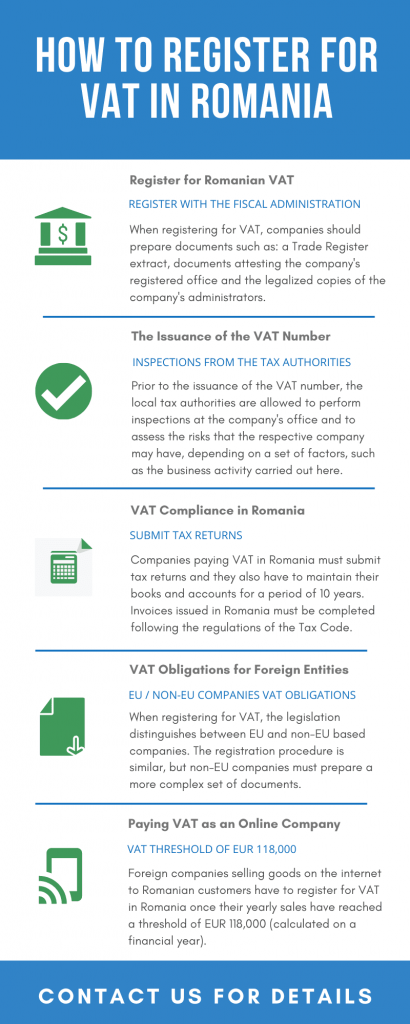

As mentioned earlier, all types of entities that are liable to the payment of the VAT must conduct the necessary steps for VAT registration in Romania.

This also applies to foreign businesses, and the manner in which they will register for VAT purposes will depend based on their tax residency; our team of lawyers in Romania can provide in-depth tax consultancy services.

The Romanian tax legislation distinguishes between EU based companies and non-EU companies, which means that the issuance of the Romanian VAT number will differ for these entities.

In the case of EU based companies, the list of documents is comprised of fewer documents compared to non-EU businesses registering for VAT, as per the requirements of the Romanian Tax Office.

An EU company should prepare documents such as:

- the VAT certificate issued in the country where it is incorporated;

- the company’s statutory documents;

- an extract from the Trade Register in its country of origin;

- various documents that will show the fact that the business activities developed in Romania are to be considered taxable transactions.

Our team of lawyers in Romania can provide legal assistance on the documents available in this case and can also offer information on the papers required for VAT registration for non-EU businesses.

Documents necessary for VAT registration for non-EU companies in 2024

VAT formalities must be carried out by non-EU businesses that want to develop their operations on the Romanian territory. For this, a similar procedure with the one applicable to EU businesses must be conducted, the main difference referring to the list of documents that must be prepared.

The non-EU business must also provide the documents presented above, necessary for EU businesses, but a larger set of documents must be submitted, which also includes the documents mentioned below:

- a document attesting the commencement of activities of the non-EU company;

- a power of attorney which presents the name of the person who is appointed as a fiscal representative;

- appointing a person as a fiscal representative who is a Romanian resident and who will act in the name of the foreign business;

- an acknowledgement of the Romanian fiscal representative which confirms the appointment as a fiscal representative;

- a copy of the VAT number or the VAT registration certificate in the country of origin.

The list of documents must also include an estimation concerning the annual sales and revenues expected by the non-EU business. Along with these, the foreign company must add to the file fiscal documents that prove the company is liable to paying the VAT in Romania.

Here, various types of agreements, contracts, sale orders, etc., can be included in the file. All documents must also contain a translation in Romanian; you can refer to our team of Romanian lawyers for further details concerning this matter.

In what situations is VAT registration in Romania necessary?

VAT is charged for the sale of services and products on the Romanian territory. There are certain situations when the procedure is necessary for both local and foreign companies.

Our team of Romanian lawyers have prepared a short list which presents the main cases where companies may have the obligation to register:

- an entity stores products on the Romanian territory and when the said products will be sold on the Romanian market;

- the sale and the purchase of products on the Romanian market;

- when goods are sold from Romania to other countries of the European Union (EU);

- when goods are supplied from an EU state to another;

- the organization of various events in Romania is charged with the VAT as well;

- when a company is not a VAT payer, but applies the reverse charge mechanism.

What is the reverse-charge VAT mechanism in Romania?

As mentioned earlier, the Romanian tax law recognizes the reverse-charge VAT system. This system refers to the fact that a VAT payer that should normally pay the VAT in Romania will not actually be charged with the VAT.

This system typically involves a local business and foreign business which trade various goods. The foreign company should normally pay the VAT, but if the reverse mechanism applies, the local company will be charged with the VAT.

For this to happen, both entities must be registered for VAT purposes. The VAT registration for each company must have been concluded in state where each company has its headquarters and tax residency.

The reverse mechanism applies in certain cases, for instance, when the subject of the trade is acquisition of goods at intra-Community level.

It can also apply for non-resident businesses that supply various services in Romania, and which do not have a permanent establishment in this country or which are not registered here.

Currently, the reverse-charge VAT system is applied for the following as well:

- the supply of buildings;

- the supply of parts of buildings;

- the supply of plots of lands;

- the supply of energy (only in certain cases).

This rule can also apply to entities which sell in Romania products such as:

- mobile phones;

- PC tablets;

- gaming consoles;

- laptops;

- other IT devices with integrated circuits.

For all the last 5 types of products mentioned, the reverse-charge mechanism rule is to be applied until 31 December 2026. There is also a threshold that must be respected in order for this system to be applied.

The purpose of the system is to avoid the need to conduct the procedure for VAT registration in Romania for the foreign company, which can be allowed to trade goods and services on this market without the need to formally register as a business or as a VAT payer in this country.

This is a system that is applied at an EU level and it is used for the following 2 main situations:

- for the intra-community supply of goods where 2 EU businesses are involved and when the 2 businesses are both registered for VAT purposes in their own country;

- for the supply of services to an EU business that is registered for VAT in its own country.

This system has created new obligations for some companies that were previously not registered for VAT, as they reached new thresholds towards their VAT registration.

If, for instance, certain companies did not have VAT taxable supplies because they were not the ones that had to be charged, under the reverse-mechanism system, they will need to comply with registration obligations.

You can find out more details concerning this from our law firm in Romania, where you can obtain qualified and up-to-date assistance on tax rules, compliance and procedures imposed to corporate taxpayers.

When is a Romanian company required to apply for a VAT number?

The law in Romania stipulates several legal scenarios that can trigger the need to register for VAT as a taxable entity. One can start the registration for VAT before commencing any business activity.

A company can also apply for the VAT registration during the financial year, when the company observes that the turnover has reached or surpassed the EUR 88,500 threshold. Companies selling goods over the internet to Romanian clients (foreign companies that are not registered in Romania) must register for VAT once they reach EUR 10,000, as per the latest regulations of the EU.

Please mind that in this situation, the formalities to register for VAT have to be concluded in maximum 10 days.

The registration is done by completing specific forms created for this purpose. One of them is the Form 098. This form contains many sections, in which the applicant must provide information on the legal entity that he or she represents.

Details concerning the name, business address and other identification data of the company are required, including the registration number issued by the Commercial Register.

The 2nd section refers to the person who completes the application (in this case this can also be the fiscal representative of the company, where the company is a non-EU business). The person who completes the application can be one of the following:

- a fiscal representative (not applicable for Romanian companies or EU companies);

- one of the company’s associate.

The 3rd section contains information concerning the VAT – the annual threshold estimated by the company, the type of VAT registration selected (due to reaching the threshold or as a voluntary registration without reaching the said threshold).

The applicant must also present the type of VAT reporting applied in his or her company – monthly or quarterly.

The document contains an annex referring to the place where the company carries out its operations and where the registered address is reported.

There are other forms that can be necessary for VAT registration and for more details referring to this matter, you can always rely on our Romanian law firm.

Rules for VAT registration in Romania

In 2018, the procedure for VAT registration in Romania was modified again, after it was changed in 2015, when the most important modification was the fact that new companies registering at a national level for VAT were no longer required to go through a physical inspection of their headquarters, but rather meet the following criteria (starting from February 2015), which are presented below.

The taxable persons must be able to perform their activity in the registered office or secondary locations. To assess this criterion one has to file an affidavit (criteria stipulated in the previous legislation has been maintained in the new provisions).

None of the directors and/or shareholders of the taxable person seeking registration for VAT purposes, according to art. 153 paragraph (1) a) and c) and paragraph. (9 ^ 1) of the Tax Code and any taxable person requesting registration under art. 153 paragraph (1) c) and paragraph (9 ^ 1) of the Tax Code cannot have criminal records.

If administrators and shareholders are not registered in Romania, they must submit an official declaration showing that they do not have criminal records.

In order to register for VAT purposes an analysis conducted by the tax authorities will be completed, showing the taxpayers’ intention and ability to undertake economic activities involving taxable operations and/or exempt from VAT deductibility, and operations for which the place of delivery/supply is considered to be abroad if the tax would be deductible if these operations would be placed in Romania.

To assess this criterion, taxpayers will have to file an affidavit (this is a new criterion, which does not exist in the previous legislation). Our team of Romanian lawyers can present extensive information on the applicable legislation concerning the procedure for VAT registration in Romania.

Note: this last paragraph basically describes an analysis which will be performed by the Romanian authorities before granting the VAT number, a procedure which is obviously left more or less at the discretion of the tax authorities.

From our experience the authorities will verify the following: the location of directors and shareholders (EU or non-EU) and the ability to perform a specific activity from the registered office or secondary office.

What are the obligations for VAT taxpayers in Romania in 2024?

After 2018, the Romanian tax authorities introduced new regulations for VAT registration in 2020, but the latest modifications were introduced for 2021 as well, after the Order no. 239/2020 was approved.

The Order was published in the Official Gazette no. 183/23 February 2021, which provides new requirements on the VAT registration in Romania.

In 2023, the rules for VAT registration have been modified. Thus, companies are now required to register for VAT if they reach a threshold of EUR 88,500. Please note that certain modifications were brought to the VAT rates charged to certain industries.

It is also important to know that, starting with 2024, the regulations concerning the application of VAT rates have been modified. Romania maintained the same VAT rates, but now, classes of goods that were charged up until 2024 with a VAT rate are charged with a different one. In this sense, we mention that many goods are now charged with the standard VAT rate, of 19%, instead of the reduced rates.

What documents are necessary for VAT registration in Romania?

For instance, a company will not be granted with a VAT number if it is involved in the import-export of machinery as activity but has a rented apartment as registered office.

Other criteria (employees etc.) can also apply. In order to register for VAT in Romania, the following documents will be required to be filed with the Fiscal Administration:

- the special forms per the provisions of the law applicable in the field;

- the Trade Register Extract showing that the respective taxpayer fulfills the conditions for activating;

- the copy of the document related to the company’s seat or secondary headquarters of the Romanian company;

- the legalized copies of the ID documents of the administrators/directors;

- the long-term visa/certificate emitted by the Romanian Office for Immigration for non-EU directors and the copy of the Certificate of Registration.

The Romanian tax authorities granting the VAT number will firstly assess the level of risk for the respective business, depending in a series of factors, such as:

- the type of business;

- the type of location of headquarters;

- actual company “substance”- referring to the possibility of the entity to conduct the respective business in the country from the rented location and the area of business (certain areas of activity are considered more risky than others).

For instance, in some areas of import-export there are more registered cases of VAT fraud. The tax authorities have also recently requested a number of additional documents from both Romanian or foreign shareholders and directors such as the proof of income (in Romania or abroad) and general business experience.

What are the VAT rates in Romania?

The VAT rates available in Romania were reduced, starting with 1st of November 2018. Under the new regulations of the VAT law, the standard VAT rate was maintained at its known value.

However, the reduced VAT rate available in this country was further reduced for specific types of products and services, while the new legislation introduced a second reduced VAT rate. Currently, the following types of VAT rates are applicable in Romania:

- the standard VAT rate is of 19%, charged for a wide range of goods and services sold here;

- a reduced VAT rate of 9% is applicable for goods such as foodstuffs, pharmaceutical products, water supplies, medical equipment for persons with disabilities;

- the second reduced VAT rate is charged at a rate of 5%;

- the VAT law in Romania stipulates that intra-community passenger transportation and international passenger transportation is charged with a 0% VAT rate.

Our team of Romanian lawyers can offer an extensive presentation on other types of goods or services that can now be charged with the 5% VAT rate, following the latest modifications brought to the VAT rules in 2024. We also mention that certain goods that were charged with the 5% VAT rate are now charged with the 9% reduced rate.

What are the obligations for VAT compliance in Romania in 2024?

Once a company received a VAT number in Romania, its representatives will need to conclude a set of VAT compliance procedures. This also applies to foreign companies that develop business operations charged with the VAT on the Romanian territory.

Throughout the financial year, a company should prepare invoices following the requirements of the Tax Code and maintain its books and records for a period of at least 10 years.

Specific VAT documents must be submitted with the local tax institutions according to the tax period applicable for a local business, which is established on a monthly or quarterly basis. The VAT is payable in a period of 15 days since the respective reporting period ended.

We invite you to watch a short presentation on VAT registration in Romania:

Taking into consideration all recent developments we would consider Romania one of the EU countries where it’s most difficult to obtain a VAT registration at a national level.

Businessmen should consider that the VAT registration in Romania can last up to 2 months. For more information and for legal assistance during this process, we invite you to contact our team of Romanian lawyers.