MHC Law Firm is able to provide full representation for obtaining an EORI registration in Romania. This can be done by us filling in the necessary application in behalf of your company and filing it with the Romanian authorities. Our team of Romanian lawyers can help you in this procedure.

The law that grants access to information on the EORI system in Europe is the EEC No. 2913/92, amended last in 2005 by the Regulation (EC) No 648/2005.

Entities that have to obtain an EORI number must know that the EORI system has recently been updated, in the sense that companies or other economic operators must provide information on their postal code. This is mandatory starting with February 2024 and it applies to entities that will request the issuance of an EORI number, as well as to those who are already registered.

If you registered for EORI in Romania, you need to address the Romanian customs authorities for the modification of your company data.

Table of Contents

What is a Romanian EORI number?

The Romanian EORI number is a number (unique) identifiable within the European Community, the customs authorities or other authorities in Romania which can require economic operators to use this code in specific situations. The EORI number is required for most of the customs activities and it can be issued for both natural persons and legal entities.

The EORI (Economic Operator Registration and Identification) number became applicable in Romania, and at the level of the EU, starting with 1st of July 2009. The system was created with the purpose of having a unitary system that can easily track the goods that are traded at the level of the EU and it is applied to all commercial operators in the EU, Romania included.

However, it must be noted that the requirement to have an EORI number in Romania and in other European countries is not only necessary for EU economic operators, but it is also required for entities trading in the EU and which are registered in countries outside the EU. If this is the case, specific procedures have to be concluded.

Considering that the non-EU entity is registered outside the community, the issuance of the EORI number can be handled by the EU country where the first import operation takes place. For instance, if this place is Romania, then the non-EU company should address to the Romanian customs authorities, which will handle the procedure. Our team of lawyers in Romania can offer full legal representation to companies interested in applying for a Romanian EORI number.

Please mind that starting with 1st of July 2021, goods that are imported from the European Union (EU) will be charged with the VAT. The exemption on this is applicable to goods that are not imported for a commercial reason, and which are imported/brought by a private person (natural person) to be given to another private person, as long as the value of the goods is below EUR 45. The import of goods from third party countries that have a value below EUR 150 will also be charged with the VAT – the rules applies from 1st of July 2021 as well.

What are Romanian EORI numbers used for in 2024?

Any Romanian company importing or exporting goods will be assigned with a registration and identification number, used for each operator to serve as a common reference in the relations with customs authorities throughout the European Community. This information will also be exchanged between customs authorities and between any other involved authorities. More information on when the EORI number can be required may be provided by our law firm in Romania.

Is the EORI registration compulsory in Romania?

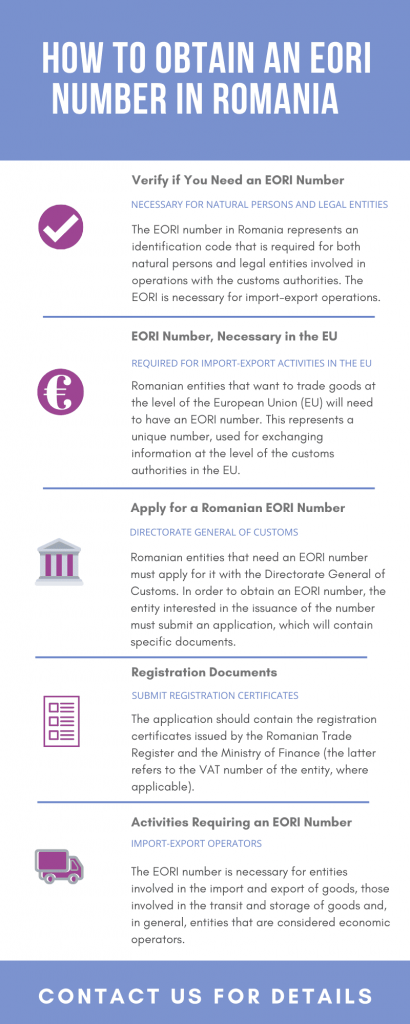

The following legal entities and natural persons are required to register for EORI: operators (persons which during their professional activities covered by customs legislation, such as the import, export, transit, storage, representation and operations prior to arrival/departure of the goods that are inserted or removed from European Community) and persons other than economic operators that introduce or remove goods to and from the EU. Our Romanian lawyers can present further information on the documents economic operators should complete when dealing with the local customs authorities.

How can I obtain an EORI number in Romania in 2024?

In Romania, the competent authority for registering and assigning EORI numbers is the Directorate General of Customs, working under the National Agency of Fiscal Administration. The EORI numbers will be required at regional customs departments for each territorial jurisdiction where the company seat is located and in some exceptional cases, at the border customs offices. Our team of Romanian lawyers can offer more information on the procedure.

In order to be assigned with an EORI number, the entity/person is required to submit an application for registration (this application can be filed by our law firm in Romania). This application is available at the Romanian Customs Authority. The Romanian legal entity or person will also be required to provide supporting documentation, such as:

- the registration certificate issued by the Romanian Trade Register or similar other registration documents issued by competent authorities in this regard;

- the registration certificate for VAT purposes issued by the Ministry of Finance, if applicable;

- the document showing the registered fiscal residence, as appropriate, in the event that it does not correspond to that specified in the certificate(s);

- ID copies, in case of individuals who need to have an EORI number in Romania.

What is the law regulating the EORI numbers?

The basic rule of law which regulates the implementation and the legal framework for EORI numbers at the level of the EU is the Regulation (EC) 312/2009. In Romania, the legislation was approved under the National Agency for Fiscal Administration (ANAF) Vice-president Order no. 1554/2009, which regulated the technical procedures through which the customs authorities must issue the EORI number.

Companies in Romania and other entities that are considered economic operators that must be the holders of an EORI number should address to the regional office of the General Directorate of Customs, operating in the regions where the companies are registered. For this purpose, it is necessary to address to the Regional Directorate of Excise and Customs, which will be able to issue the EORI number in a period of approximately 2-3 working days.

Please know that if you want to apply for an EORI number in 2024 in Romania, there can be certain exceptions from this rule. In general, all entities that deal with the import or the export of various goods and products have to be the holder of an EORI number.

However, the exemption applies to subsidiary companies or multinational companies that are not allowed to have their own EORI number. They do not have to apply for an EORI in 2024 because their parent company has one and they must use that code.

Another exemption is granted to entities that conduct very few customs operations on a yearly basis. The need to have an EORI is applied to those who have minimum 9 customs operations per year.

What is the value of imports and exports in Romania?

Considering that the EORI number in Romania is required for businesses and natural persons developing import-export activities at the level of the European Union (EU) and outside the community, we have prepared a short presentation on the value of exports and imports registered in this country. Romania is an important market for the import and export of goods, and in this sense, the following are available:

- in 2018, Romania was the 34th most important export market, in a list containing 119 jurisdictions;

- when referring to the level of imports, Romania was rated as the 33rd market;

- in 2018, the total level of imports accounted for $80,077 million;

- the total value of the imports registered by Romania in 2018 accounted for $97,877 million;

- the top export partners for Romania were the following countries: Germany ($18,391 million), Italy ($9,152 million) and France ($5,686 million);

- the most important trading partners for import matters were: Germany ($20,025 million), Italy ($9,185 million) and Hungary ($6,717 million).

The value of the exports in Romania in November 2023 (the latest data) was $8.9 billion and the top exported goods were vehicles, Germany remaining the 1st export market, followed by Italy and Hungary.

Below, you can watch a short presentation on the legal steps for having an EORI number in Romania:

What does an EORI number look like?

The structure of the EORI number established by the European Commission is composed of an identifier code of the Member State assigning the number (ISO alpha 2 country code consisting of two alphabetic characters) followed by a single national identifier state code (up to 15 alphanumeric characters).

The structure of the EORI number can also vary based on the legal nature of the applicant. For instance, in Romania, a legal entity will have as an EORI number a code that is formed of the following: RO (letters designating Romania) and the unique identifier code (CUI). If we refer to foreign entities applying for an EORI number in Romania, the structure of the number will look as follows: RO + the ISO alpha 2 code of the country where the company is registered + the identity number issued by the institutions of the respective country.

Natural persons who need to have an EORI number in Romania will have a code that will resemble the number addressed to legal entities, with the difference that instead of the CUI, the person’s identity number will be used. Natural persons who have to apply for an EORI number in this country are invited to request for more information on the procedure and the documents they should submit from our team of Romanian lawyers.

In Romania it was determined that the unique structure of the EORI number for resident companies (Romanian companies) to be the unique identifier (CUI). This is the same number assigned by the Trade Register upon registering a new Romanian company. Please contact our Romanian law firm for further information on the issuance on the EORI number.