by Vlad Cuc

It is possible under the Romanian Law to establish branches (or subsidiaries) of an existing foreign company starting its business activities in Romania. A branch office or a subsidiary in Romania defines a place of business where a company establishes its secondary quarters. Our team of Romanian lawyers can provide an extensive presentation on the characteristics of these two structures and can also assist investors in registering a branch office or a subsidiary in Romania.

| Quick Facts | |

|---|---|

| Applicable legislation for a branch (home country/foreign country) |

– the Romanian legislation – Corporate Law 31/1990, – Law No. 105/1992 regulating Private International Law Relationship |

|

Best uses for a branch |

Establishing a company branch in Romania is best used for developing the same business activities carried out by the parent company, while implementing the same business strategy. |

|

Minimum share capital for a branch |

Not applicable |

| Time frame for the incorporation for a branch (approx.) | Minimum 3 business days (the time frame refers to the basic incorporation procedures, through which the branch obtains its registration documents). |

| Documents to be filed by parent company for the branch registration |

– the articles of association, – the registration certificate issued in the country of origin, – the resolution for establishing a company branch in Romania, – documents presenting the financial situation of the parent company, – the power of attorney issued for the legal representative of the branch, – translated and notarized versions of the said documents (only documents in Romanian are accepted). |

| Management of a branch (Local/Foreign) |

Foreign management is allowed. |

| Obligation to appoint a legal representative for a branch |

Branches operating in Romania must have a legal representative. |

| Branch independence from the parent company |

The branch office is an entity that is fully dependent on the parent company. |

| Definition of a subsidiary |

A subsidiary is a legal entity that is set up by the parent company abroad, but which has independence from the parent company unlike to the branch. |

| Legal entities for a subsidiary in Romania |

The subsidiary can be incorporated as one of the legal entities available in Romania. Most foreign investors will choose the limited liability company or the joint stock company. |

| Ownership requirements for a subsidiary |

The parent company is the main shareholder of a subsidiary, and it must hold at least 51% of the subsidiary’s shares. |

| Possibility of hiring local staff for a subsidiary (YES/NO) |

Yes |

| Travel requirements for incorporating the subsidiary (YES/NO) |

No |

| Tax obligations for a subsidiary |

The Romanian subsidiary is liable to paying all the taxes prescribed by the Romanian tax law, unless exemptions are granted. Companies pay corporate taxes, employment taxes, withholding taxes, VAT. |

| Double tax treaty access | The subsidiary benefits from the provisions of the double tax treaties signed in Romania as per the rules of the European Parent-Subsidiary Directive no. 2011/96/EU. |

| Best uses for a subsidiary | The subsidiary is a legal entity through which a parent company can minimize financial risks, establish a separate management structure, separate the parent company’s business activities and obtain various tax advantages. |

|

Minimum share capital for a subsidiary |

RON 1 for a limited liability company and RON 124,000 – the equivalent of EUR 25,000 – for a joint stock company |

|

Institutions in charge with tax registration |

Ministry of Public Finance, National Agency for Fiscal Administration |

| Tax registration obligations for subsidiaries |

The subsidiary must obtain a tax identification number and apply for a VAT number. It must submit tax reports as required by the Romanian law. |

| Owning property |

Establishing a branch or subsidiary in Romania grants the right to own property here. While the subsidiary can own its property and assets, for the branch, the owner is the parent company. |

| Mandatory VAT registration |

Mandatory VAT registration is imposed when a company exceeds RON 300,000 in annual turnover. |

| Types of parent companies establishing a branch or subsidiary in Romania |

The parent company can be a locally incorporated business or a foreign company with its seat registered overseas. |

| Bank account registration obligations |

It is mandatory to open a corporate bank account at a local commercial bank in Romania. |

| Who can be appointed as the director of a Romanian subsidiary? |

Any natural person with an age above 18 years, who doesn’t have to be a Romanian national. |

| Can a company be set up for a specific amount of time? | Yes |

| Registration obligations for branches of financial institutions |

Branches of financial institutions must obtain approval from the Romanian National Bank. |

| Documents to be submitted by the branch representative upon incorporation |

Identity documents and a statement of own responsibility. |

| Can a company have more branches in the same locality/municipality? |

Yes |

| Publishing obligations upon registration |

After establishing a branch or subsidiary in Romania, it is necessary to publish the registration of the entity in the Official Gazette. |

| Publishing fees charged by the Official Gazette | RON 128 per page |

The difference between the two types of entities resides in the rights granted by the parent company to these structures; thus, a branch office has limited powers, being a sub-division of the parent company, while the subsidiary is a separate legal entity, with its set of management rights. For a better understanding of these types of entities, please find below some of the basic characteristics of each one.

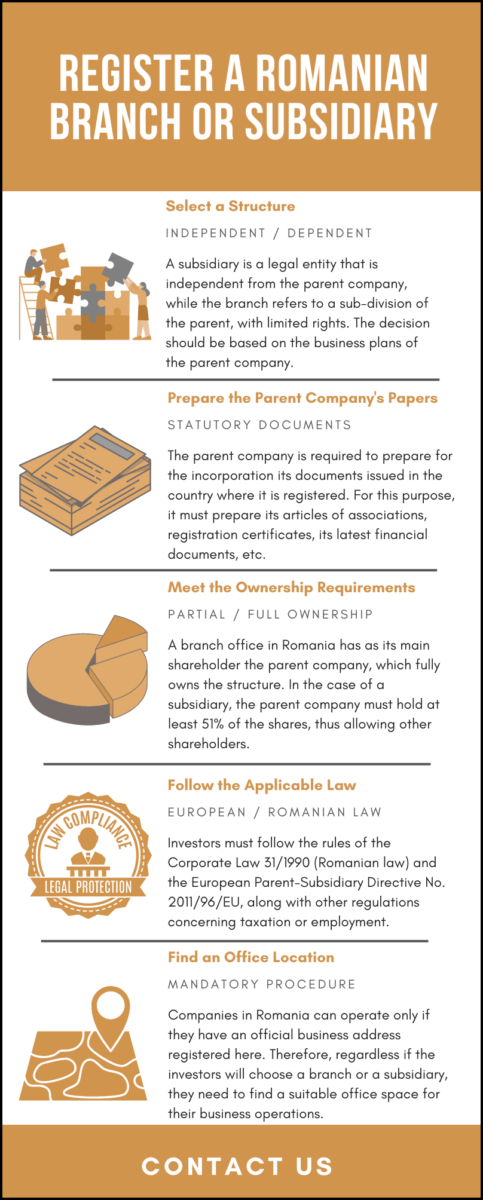

In order to open a business in Romania as a branch office investors will need to follow the same incorporation procedure that is applicable to other company types.

The main difference between a branch office and companies with legal personality is that for the first, the parent company will be held responsible for debts and other obligations, while the same rule will not apply for the latter.

The procedure for company formation in Romania for the branch office and for the subsidiary is approximately the same. Please mind that the subsidiary will be incorporated as one of the legal entities prescribed by the national legislation.

In most of the situations, foreign investors will opt for a limited liability company or for a joint stock company, depending on their preferences and the size of the company.

Investors who will start a business here must also have an official place for doing business (as a part of the mandatory incorporation procedure). Businessmen have the possibility to rent an office or to buy a property in Romania.

If they will opt for the purchase of a property, a large set of documents must be prepared and here, our lawyers can be of assistance.

Table of Contents

Characteristics of a sub-company in Romania

According to the provisions of the Law No. 105/1992, a sub-division of a Romanian legal entity that is registered in a foreign country has a different nationality from the one of the parent company located in Romania. The Romanian sub-company is conceived as an entity with legal personality in the sense that it is constituted in the same manner as a company and depends economically on the mother-company.

The sub-company owns its patrimony, distinct to the entire patrimony of the company and is able to sign contracts with third parties in its own name, also owning one or more bank accounts. The sub-company can be legally viewed as an entity organized under the form of a separate company having its own legal personality per the stipulations of Law No. 31/1990 and Law 26/1990, which can be detailed by our team of lawyers in Romania.

What are the main documents for opening a Romanian subsidiary in 2024?

In order to register a Romanian subsidiary, the company’s representatives have to prepare a set of documents, that will be registered with the local authorities. A subsidiary has to be registered with the National Trade Register Office in the region where the company is incorporated. Our team of Romanian lawyers can provide legal representation to those opening a subsidiary and may assist with advice on the full list of documents required in this case. Investors should prepare the following:

- the company’s name (it must have the name of the parent company and it also needs to include the region where it is set up in Romania);

- the Trade Register application forms, alongside the required annex documents;

- the company’s bylaws (the articles of association and memorandum of the parent company);

- the parent company must also provide a Certificate of Good Standing or an equivalent document;

- a document stating the fact that the parent company has decided on opening a subsidiary in Romania;

- information on the company’s official business address in Romania.

What are the tax obligations for a Romanian subsidiary?

Since the company is considered a commercial entity, it needs to be registered for tax purposes. The tax requirements applicable to Romanian business forms, including to the subsidiary, can be found in the Fiscal Code, which provides the legal basis for the accounting requirements and tax obligations imposed to local businesses. Our law firm in Romania can provide an extensive presentation on the main types of taxes applicable to a Romanian subsidiary. Some of the main fiscal obligations are presented below:

- local subsidiaries have to register with the Ministry of Public Finance;

- the institution will issue a tax identification number, necessary for corporate taxpayers;

- the company also has to register for value added tax and to file tax returns;

- the tax returns are administered by the National Agency for Fiscal Administration;

- subsidiaries in Romania can also choose not to register for value added tax, in specific conditions.

Characteristics of a branch in Romania

The branch office represents another way of expanding a business activity; this can be done at a national level, but it can also be set up on foreign markets. Unlike the sub-company, the Romanian branch does not become a distinct legal entity, being part of the structure of the mother-company.

Referring to the branch offices in Romania, Law No. 105/1992 stipulates that their activity statute is under the rule of the national law of the parent company (which can be identified by its social headquarter). Taking into account this information, it must be noted that a Romanian branch must be viewed from a legal point of view as a simple “representative”, territorial exogenous from the mother-company. The differences between a branch and a sub-company are:

- the branch has no distinct existence, nor its own patrimony different to the mother-company;

- as opposed to this, the Romanian subsidiary possesses all these characteristics;

- the assets belonging to the branch belong to the mother-company;

- the branch can enter contractual relationships with third parties, either on behalf of the mother-company or their own, but on the expense of the founder;

- a branch office in Romania cannot have either creditors or debtors.

What are the main steps in opening a Romanian branch in 2024?

The registration of a branch office in Romania benefits from a simpler procedure (compared to the registration of a subsidiary), which can be detailed by our team of Romanian lawyers, who can also represent foreign businessmen in registering for VAT in Romania. The incorporation of this structure is done with the local Trade Registry and the investors will have to prepare an extensive set of documents.

Since our team of lawyers in Romania can represent investors in this procedure, they can grant the power of attorney to our law firm, this being one of the main documents necessary in this case. The power of attorney must also be granted to the local representative, who is appointed to represent the Romanian branch. Besides this, investors must provide the translated version of the parent company’s articles of association and memorandum, the parent company’s latest financial situation, the decision for setting up a branch office in Romania and other compulsory papers.

We invite you to watch a short presentation on how to open a branch or a subsidiary in Romania:

Once the branch office is registered, all its stationery, order forms and other documents have to contain information regarding the registration data of the branch. Thus, there is a legal obligation to show the following: the place where the parent company is registered, the parent company’s registration number, the classification of the company as well as the place where the registered office is located.

Then, it is required to present the place where the branch office was registered (in this case, Romania), along with the registration number issued for the branch office by the Romanian institutions. For more details, our lawyers in Romania can answer to any of your questions, and can present the main advantages you’ll have when operating through a branch or a subsidiary.

What should a businessman know about the foreign investments in Romania?

Foreign investments are of high importance for any jurisdiction, including Romania. In the last years, the level of foreign direct investments grew at a steady pace, with relevant investments concluded in the manufacturing and the industrial sectors. Our team of lawyers in Romania can assist investors with information on the legislation regulating foreign investments in this country and can also represent them when investing in a particular economic sector. The foreign investment sector in Romania is characterized by the following:

- in 2018, the level of foreign direct investments increased by 2.8% compared to 2016;

- in 2017, the manufacturing sector in Romania attracted EUR 1.2 billion;

- in 2018, the total value of foreign direct investments in Romania was EUR 4.9 billion;

- in the first 10 months of 2018, the foreign direct investments in Romania accounted for EUR 4.56 billion;

- this represented an increase of 9.74% compared to the same period of 2017, as mentioned by the National Bank of Romania;

- in 2019, the projections show that the foreign direct investments value will reach EUR 5 billion.

What are the new regulations of the Tax Code in 2024?

Due to the effects of the Covid-19 pandemics, the new Romanian Tax Code prescribe various tax benefits for remote work, which has become increasingly popular amongst most of the businesses that have a office activity. Thus, employers granting a maximum of 400 RON to their employees to cover utility costs while working from home are exempted from paying the tax and social contributions for the said sum of money in 2021 and in the next years. The rule became applicable starting with 1st of January 2021.

Starting with 1 January 2023, the dividend tax has been increased from 5% to 8% (for the distributions made to both resident and non-resident entities).

The micro-entreprise regime has also been slightly modified, in the sense that companies which want to qualify for the micro-entreprise tax regime must have at least 1 full-time employee and to have an income of up to EUR 500.000. This type of company can benefit from a corporate tax of 1% for a revenue below EUR 60,000 and a 3% corporate tax for revenue above EUR 60,000.

It must be noted that starting with 1 January 2024, the VAT regulations in Romania have been modified. The VAT rates are maintained at the same levels – 19%, 9%, 5% and 0%. However, the classes of goods and services that were previously taxed with the reduced VAT rates were introduced in the list of goods and services taxed with the standard VAT rate, this being one of the main changes that should be of concern of businesses that develop taxable activities here.

Characteristics of a Romanian representative office – “reprezentanta”

This external structure is substantially different from both the Romanian branch and the sub-company, as a representative office in Romania cannot be an enterprise producing goods or any type of service provider. Our law firm in Romania can provide more information on the main legal requirements necessary for starting a local representative office.

A representative office in Romania is simply an intermediary between the mother-company and its current contractual partners, thus exercising either mandatary or commission functions. As a mandatary, it is able to enter contractual relationships with third parties on behalf of the mother-company. In this way, the representative office lacks the legal personality belonging to the mother-company.

Although the representative office in Romania does not conduct any commercial activities, from which it can gain money, the unit needs to set up a bank account at a local Romanian commercial bank. This is a necessary procedure, as the parent company abroad will fund the respective account with the necessary capital in order to conduct its operating activities and pay various financial obligations.

For instance, although the representative office will not gain a revenue from commercial activities, it will still be liable for the payment of various local taxes – the unit must have at least an employee, who will be registered for social security in Romania and this will create a tax obligation.

At the same time, the unit must also pay for current utility bills – internet, mobile phone, landline, etc., are just some of the necessary services (and costs) that must be covered by the parent company. Since the representative office will be located in a physical place, the parent company must also take into consideration paying the rent.

In the case you want to register a representative office in Romania, our team of Romanian lawyers remains at your disposal for advice on the registration procedure, which is slightly different than the one applicable to other legal structures available for registration in this country.

Of course, our Romanian lawyers have the necessary expertise to help you in the process of opening a bank account for the representative office and can also intermediate the process of finding a suitable office space. More importantly, our attorneys can provide consultancy services when signing a rental contract.

What documents are necessary for registering a Romanian representative office?

Just like in the case of a branch office or a subsidiary, foreign investors are required to prepare a set of documents for the registration of the Romanian representative office. However, the list of documents is far less extensive than in the previous two cases.

A Trade Register extract from the country where the foreign company is incorporated will be required, along with the company’s Certificate of Registration issued by the authorities of the same country. Then, the representative’s office incorporation documents have to be prepared and signed, and added to the registration file in Romania.

A specimen signature of the person who will act as a representative will be required as well, together with the power of attorney. Please mind that the representative office needs to own a license that is issued for a period of one year, and the document can be renewed on a yearly basis, provided that the unit will maintain its activities.

The license is only a part of the authorization process, as the representative office must also register with the Ministry of Public Finances, for the purpose of paying an income tax, established at EUR 4,000. For more details, please contact our Romanian law firm, where you can receive more information on any other tax obligation associated with this unit.

Legal details concerning the taxation of a representative office in Romania in 2024 can be found in the Romanian Fiscal Code – Title V.

What entities are required to pay the income tax in Romania?

In this article, our Romanian lawyers have presented information regarding branch offices, subsidiaries and representative offices. Although all structures represent entities that can be incorporated as local units of foreign companies, each of them has specific characteristics and tax obligations.

However, all of them are required to pay the income tax, which can be calculated as a standard threshold (as it is the case of the representative office), or calculated as part of the company’s income or on the global income of the company.

In Romania, the branch office is seen as a permanent establishment of the parent company, which means that it will be necessary to pay the corporate income tax, charged at a standard rate of 16%, but calculated only for the income obtained from the economic activities developed in this country; for other details, please contact us. This tax rate has been maintained in 2023 as well.

Investors must know that a corporate tax of 5% is applicable to gambling companies (the tax is charged on the company’s revenue). Micro companies can be charged with a tax rate of 1% of 3%.

There is also a different registration procedure of a representative office in Romania and it is done through the Ministry of Economy and Commerce. MHC Law Firm is able to provide help when establishing any kind of branches in Romania and provide a complete list of requirements for this purpose. We remind our clients that MHC Law Firm is a law firm with international affiliates. In this respect, we are happy to present our affiliates in Singapore, company formation specialists DM Advisory.